Ethereum mining will soon meet its end.

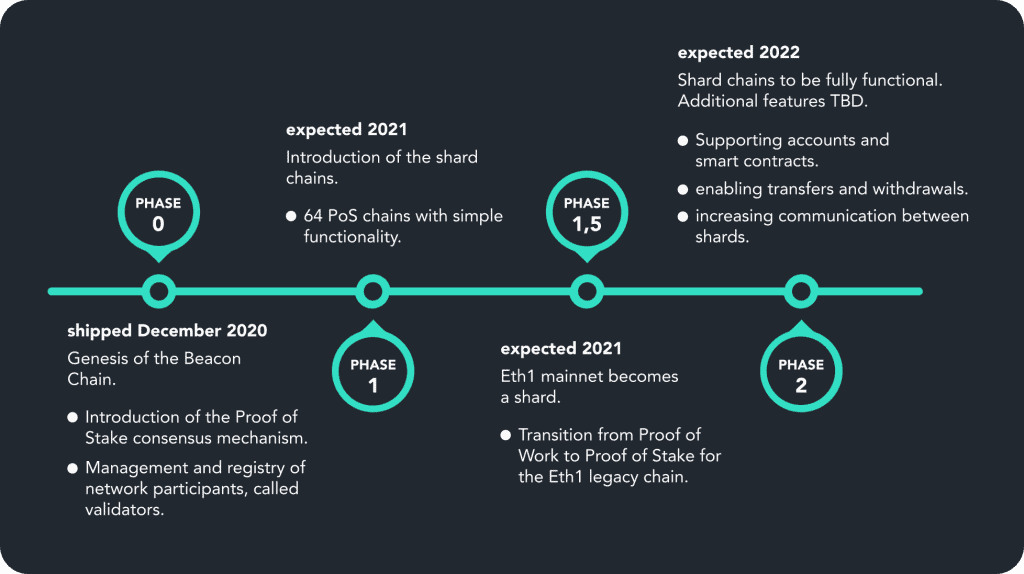

A tough pill to swallow for a successful miner, but an impending reality as the network transitions from Proof of Work (PoW) to Proof of Stake (PoS) consensus, with the merge of Eth1 and Eth2 in the next year or two.

No need to panic though, there will be plenty of warning ahead of the merge, and the opportunity to generate ETH mining rewards still remains a viable source of crypto income until then. However, the transition is certainly imminent as the world’s second-largest, and most actively used blockchain kicked off Phase 0 of its upgrade at the tail end of 2020 – geared at increasing the network’s longevity and serving as many people as possible.

Some consensus algorithm history

PoW, first implemented as the consensus algorithm behind Bitcoin in 2009 (though it was invented many years before) introduced distributed consensus to the world with a mining process that confirms transactions and mines new coins while adding blocks to the chain. Each miner is competing against all others in order to be the beneficiary of the rewards issuance and must complete a complex algorithmic problem (hashing) in order to do so.

In theory, anyone can be a miner – with the right equipment and technical know-how to get the job done. The rewards issuance they receive is two-fold, newly minted tokens from the network (2 ETH per block in Ethereum, 6.25 BTC for Bitcoin) and transaction fees from network users (reaching all-time highs as of late). With the right set up, this can become a very lucrative endeavor over time.

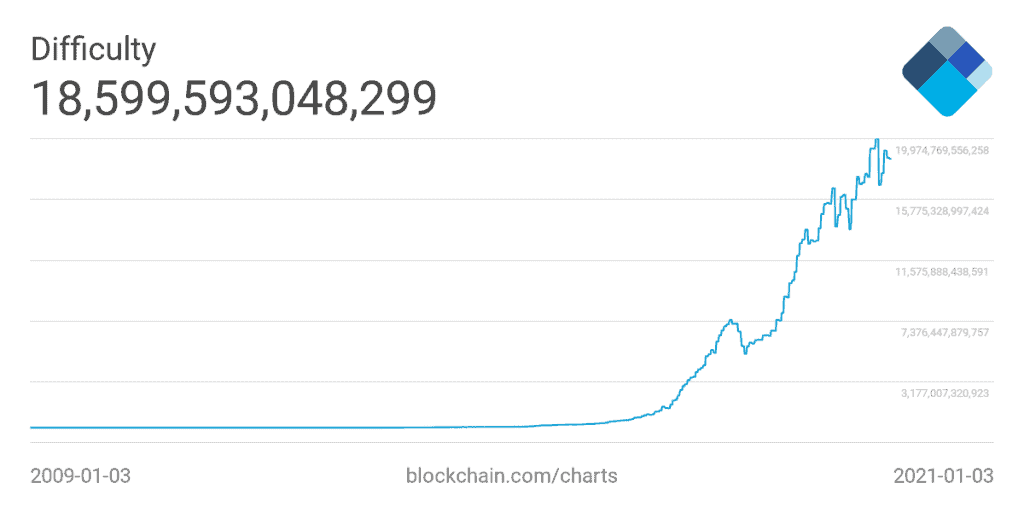

Mining difficulty of bitcoin and ethereum

But flash forward a number of years after Bitcoin first hit the scene, and what’s ended up happening is different than the initial intent. It can be quite costly to become a miner, and networks are gradually succumbing to centralized control by individuals and corporations that can afford the high operating costs.

Mining rigs are expensive, and ever-improving, driving upfront costs + as more blocks are added to the chain, the more difficult and time consuming it is to calculate the right hash.

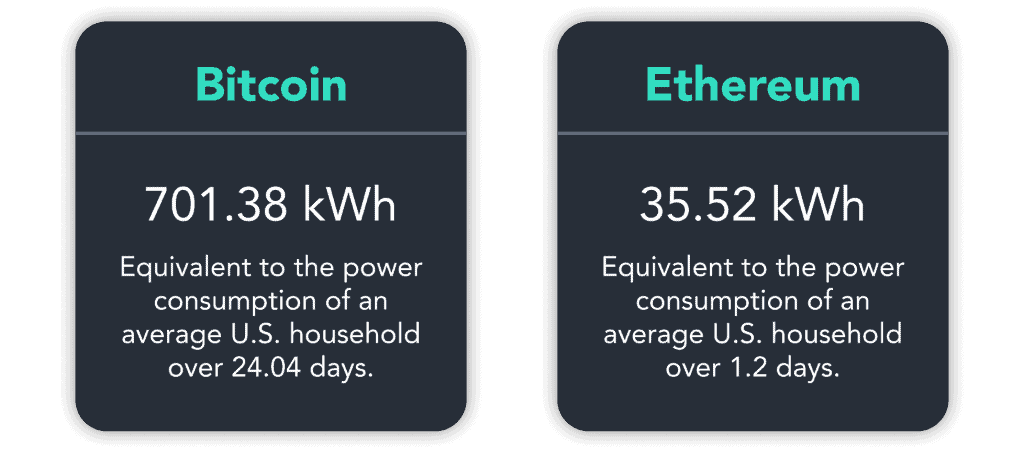

The result is that large players can outperform DIY miners and monopolize rewards + a HUGE energy draw on the miner’s operation, slowly cutting away at their bottom line (not to mention the implications this has on the environment).

Source: Digiconomist

Current problems with Ethereum and Proof of Work

Vitalik and the Ethereum Foundation have always seen the longevity limitations of PoW and the transition to a different consensus algorithm has been discussed since 2014. Not only does PoW eventually lead to high operating costs and centralization but another negative result is increased transaction latency and decreased overall throughput.

Ethereum currently can only process ±15 transactions per second (tps), Bitcoin ±4.6. VISA on the other hand claims to be capable of handling 65,000 tps, while more conservative estimates peg their actual transaction rate around 1500. Regardless, Bitcoin, Ethereum, and blockchain in general have some catching up to do if the industry is to truly disrupt the status quo.

Ethereum is changing the narrative with PoS

In Ethereum’s implementation of PoS, actors, known as validators, take turns acting out network duties and earning rewards from the beacon chain for their contributions, effectively eliminating redundant energy expenditure. It is estimated that once the switch to Eth2 is complete, Ethereum will have cut its energy consumption by 99%.

The need for expensive mining equipment is also eliminated. With a commercial-grade laptop or even a raspberry pi, anyone can run a validator. The only ‘upfront cost’ for joining is 32 ETH that is “put at stake,” meaning the Ether still belongs to the validator, but is held up in the network as collateral while they perform their duties. With each correct duty, a validator sees their stake increase, if a validator acts against the best interests of the network (malicious activity or prolonged periods of time spent offline) their ETH stake will decrease, though only severely in the case of slashing. This mechanism makes sure that validators are accountable for their actions, and if performing duties as they should with a strong attestation rate, they shouldn’t face a reduction.

But is it profitable? Staking vs. Mining costs & rewards

Upfront costs of Eth2 staking are exceptionally low and maintenance costs also (it is estimated that the cost of a DIY validator is ±$120/year). But are the rewards attractive enough? There are a number of factors involved for calculating this and it will depend highly on your mining operation, how costly it is to run, how much energy it takes to do so, and how many tokens you receive as compensation. It’s also worth asking yourself, as large mining players continue to dominate blockchain networks, can I keep this up for the long term? Once you’ve calculated all of that, then it’s time to factor in the advantages of staking and what it all means for your bottom line;

Staking advantages

- No expenditure on mining equipment (GPU, ASICS etc.) and thus no equipment depreciation

- Low maintenance expenditure (electricity costs)

- Less technical knowledge required (this should get even easier in time, but for now staking services can help)

- Estimated staking reward APY of 15-18% the first year of staking, and 8-10% the following year. Check out this staking calculator to determine what your setup could yield.

Is Staking the future of blockchain?

While PoW certainly isn’t going away, PoS represents an alternative that solves a lot of problems in blockchain and crypto today. For Ethereum, the path forward is the transition to Ethereum 2.0 staking, as PoW is just not capable of taking the network to the heights it wishes to achieve while maintaining decentralization and security. Hence, for Ethereum, validators are effectively the new (and improved) miners, giving the community the chance to help secure the network and get paid for it along the way.

Safe Staking,

Team Blox.