The arrival of Eth2 is one of the most exciting milestones in the Ethereum history book, giving the network’s supporters and enthusiasts alike the ability to run a validator, stake Ether, earn rewards and support the future of the worlds most popular distributed network.

There is great potential to leverage idle ETH for staking and generate passive income but the biggest challenge for future stakers is determining exactly how they will participate.

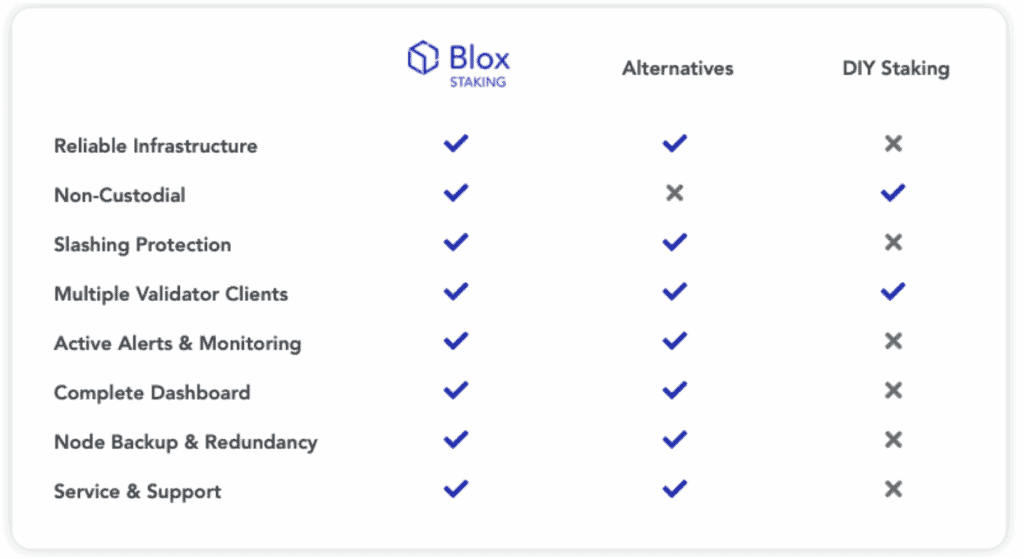

There is of course the option of DIY staking for the technically inclined, but for the rest of us, the answer will likely be to go with a staking-as-a-service provider.

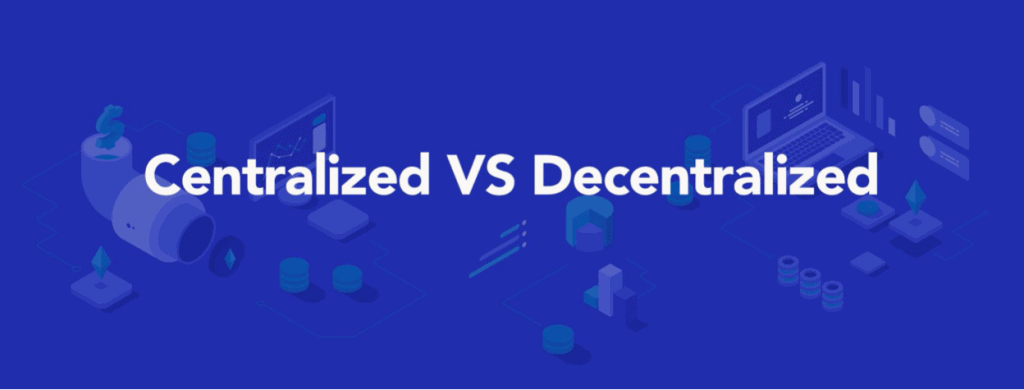

The diffence between centralized and decentralized Eth2 staking services

Eth2 staking will certainly undergo a whirlwind of changes, but at present there are two types of staking services to choose from, centralized and decentralized. In this post, we’ll analyze the differences between the two to help give you a better idea of which one is right for you.

Centralized Staking Services

Providers that manage the entire ETH staking process on behalf of the user and retain ‘custody’ over user private keys. This could apply to both private keys (custodial staking) or just one (semi-custodial staking).

There are many centralized staking providers in operation today that provide services for other cryptocurrencies (and soon to include ETH upon mainnet release). These services are often provided by crypto exchanges, such as Binance or Coinbase. Users simply deposit or transfer their funds into the exchange and the provider will handle the rest.

Centralized Staking Benefits

- Easy & fast onboarding

- Great for beginners

- Does not require elaborate infrastructure

- Staking with less than 32 ETH

- Maintains superior liquidity

Exchanges and centralized service providers do make the process of staking very easy (especially if they are already holding your assets). This however comes at the price of custody over assets which comes with its own set of risks including, severe slashing penalties, reduced overall rewards and increased likelihood of attack on your assets.

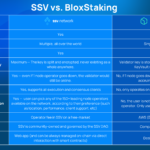

Decentralized Staking Services (dStaking Services)

dStaking Services employ a trustless implementation for staking and hence do not retain custody over its users assets in any way. In Eth2, this means a service that provides streamlined validator set-up and management, but does not hold user private validator keys AND withdrawal keys. This is an important distinction as many services will claim to be decentralized and non-custodial although they maintain custody over user validator keys. In theory, they are not able to withdraw a user’s assets without the withdrawal key, but retaining validator key custody still invites cause for concern if the service is to get hacked and/or if they are to incur group slashing penalties.

Decentralized Staking Benefits

- Complete control over private keys and ETH

- Does not require elaborate infrastructure

- Mitigates security risks

- Promotes network and industry decentralization

Blox Staking – Non-Custodial Eth2 Staking Platform

Blox StakingBlox Staking is the industry’s first solution for custody-free ETH staking built for anyone who wants to participate in Eth2, but does not feel comfortable with a centralized provider handling the keys to their validator. Blox is known for building, deploying and maintaining reliable blockchain nodes, apps and services, and Blox Staking is our upcoming open-source project for decentralized Eth2 staking.

Staking Service with no key-sharing

Custody-Free

Your keys are yours, and yours alone. Blox Staking will never request custody over user private keys, rather we aim to make non-custodial staking as seamless and user friendly as possible. This vision was driven when our team was looking in to staking services for Eth2 and realized that not one of them afforded its users custody over both private keys.

Maximizing ETH Rewards

Optimal uptime, inclusion distance, slashing protection and managing a validator in general will not be easy at first. When our non-technical team members tried to run testnet validators, it was clear that without technical know-how, a validator’s ETH is certainly at risk. Blox Staking aims to smooth over all of the technical aspects of staking for users and hence maximize overall rewards.

Securing Staking

A remote signing wallet powered by Hasichorp Vault protects user validator keys. This, along with employing best-in-class security practices for all aspects of the platform is our goal, you can take a look at our github for more.

If you’re curious to learn more about staking, Eth2, and Blox Staking we have more blog posts and docs pages for you to explore.

Safe Staking,

Team Blox