Eth2 staking rewards explained

Following the release of the Eth2 deposit contract earlier this month, Ethereum 2.0 staking has at long last transitioned from an exciting prospect to a real-life opportunity. The blockchain network’s move to Proof of Stake (PoS) consensus opens the doors for more people than ever to receive rewards for participating in Ethereum. But how much can you really expect in staking rewards if you stake your ETH?

What exactly is staking and how to generate Eth2 staking rewards

Staking on the Ethereum network and other Proof of Stake consensus blockchains requires actors (known as validators in Eth2) to provide network tokens to attain involvement in the consensus mechanism of the network and receive compensations in exchange. The minimum amount required for staking on Ethereum is 32 ETH.

Theoretically, anyone with the right amount of ETH can generate passive income by running Ethereum nodes, and validator client software that adds and verifies blocks on the Eth2 Beacon Chain. In practice, operating these programs and ensuring the correct execution of validator duties is less passive and more technical – and operational missteps can lead to severe financial consequences, minimizing overall rewards.

Validator performance parameters and risks that affect staking rewards

Staking 32 ETH is the first step for participating in the Eth2 Proof of Stake mechanism, thereafter your validator’s performance can greatly affect how much you earn. Basically, the better your validator performs, the greater your staking benefits. Here are a few performance parameters to consider:

Inclusion Distance on the Beacon Chain

Inclusion Distance

The faster you propose or attest, the shorter the inclusion distance, and the higher the staking rewards.

Optimal Uptime for an Eth2 validator

Optimal Uptime

Validators earn less if they are online less. More downtime = lower staking rewards. If too many validators go offline and the chain cannot finalize (inactivity leak), validators face even steeper penalties.

Slashable offences for an Eth2 validator

Slashable Offences

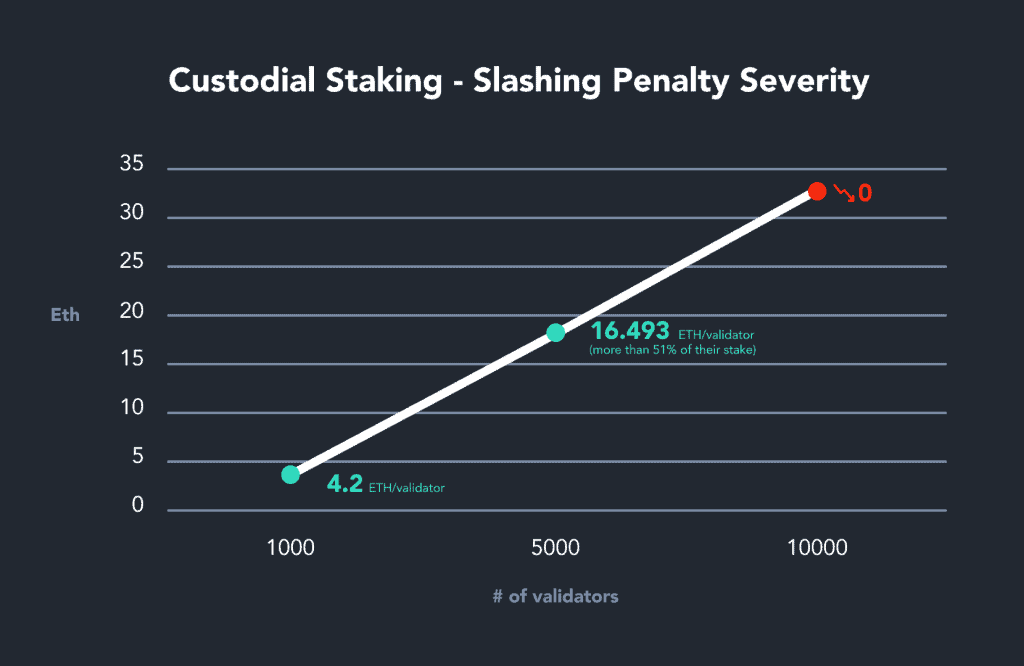

If a validator (advertently or inadvertently) proposes or attests incorrectly, they face slashing penalties – the reduction of a large amount of ETH (up to one’s entire stake) and forcible removal from the network.

If you’ve decided to go with a staking service to streamline staking, keep in mind that holding your private keys in a centralized fashion (custodial staking or semi-custodial staking) increases your likelihood of severe slashing penalties and a possible overall reduction in staking rewards as slashing penalties grow exponentially the more validators participate in the same slashable event.

Validator infrastructure costs contribute to overall staking benefits

One of the goals of Eth2 and the transition to Proof of Stake consensus is increased accessibility and decentralization. Theoretically, DIY staking should only cost about $120/year in infrastructure costs. That being said – time is money – and for a non-technical individual, the time taken to operate, protect, and optimize validator performance should also be taken into consideration.

Staking Services can alleviate the time/money factor. But beware as the cost of custodial or semi-custodial slashing could be the demise of your staking rewards and total ETH at stake. Non-Custodial Staking on the other hand lets you hold on to both of your private keys, avoid group slashing events, and ensure optimal performance – effectively maximizing potential staking rewards.

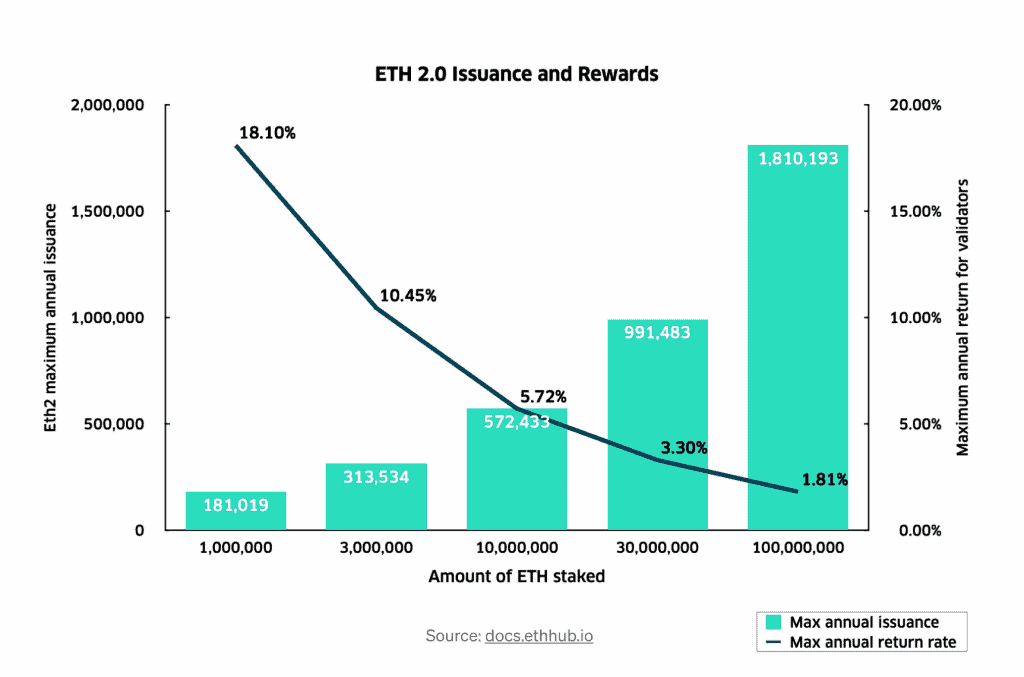

Finally, total ETH staked in the Ethereum network will affect annual rewards

The more people staking on Ethereum 2.0, and hence the more ETH staked, the lower the annual reward on average per participant. Plain and simple, this is why it makes sense to start staking early on.

The bottom line for Eth2 staking rewards

To recap, a number of factors contribute to total staking rewards including:

- Validator Performance

- Validator Duty Correctness

- Staking Infrastructure Costs

- Total # of Active Validators on the network

- Total Amount of ETH staked on the network

While impossible to give an exact number of how much you will earn, current estimates foresee between 15-18% annual percentage yield (APY) during the first year of staking, and 8-10% the following year. You can check out this neat Eth2 staking calculator to play around with the parameters and assess your Eth2 annual reward potential.

Don’t have 32 ETH to stake? Stay tuned to join a staking pool with Blox Decentralized Staking Pools, released as close to mainnet launch as we can develop it!

Safe Staking,

Team Blox